May 2025– GTA Housing Market News

Here is our quick market update!

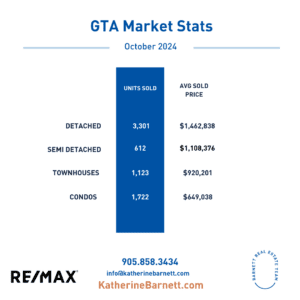

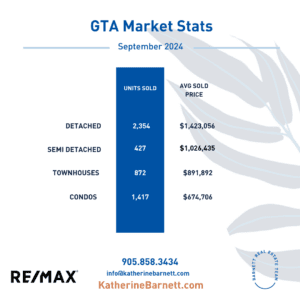

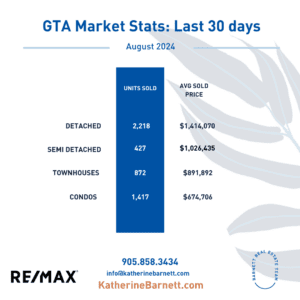

📊 GTA Housing Market Update – May 2025

Affordability Improves, Buyer Confidence Lags

The Greater Toronto Area (GTA) real estate market saw improved affordability in May 2025 compared to the same period last year. With sales down and listings up, many homebuyers took advantage of increased choice and stronger negotiating power.

“Homebuyers across the GTA are clearly benefiting from more inventory and softer pricing,” said TRREB President Elechia Barry-Sproule. “But every neighbourhood is different. That’s why it’s crucial to work with a REALTOR® who knows the local market and can help navigate specific housing needs with expertise and the right tools.”

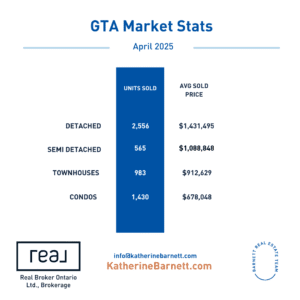

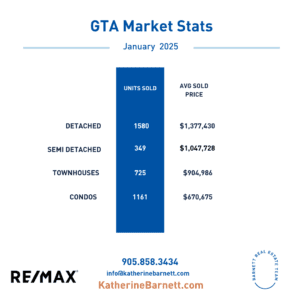

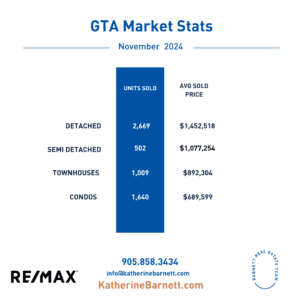

📉 Key Stats – May 2025

-

6,244 homes sold through TRREB’s MLS® System

🔻 Down 13.3% from May 2024 -

21,819 new listings

🔺 Up 14% year-over-year -

Average selling price: $1,120,879

🔻 Down 4% year-over-year -

MLS® HPI Composite Benchmark:

🔻 Down 4.5% year-over-year

On a seasonally adjusted basis, sales were up month-over-month for the second straight month, while listings also rose, though at a slower pace—indicating a slight tightening in market conditions.

💬 Expert Insight

“Ownership costs are more manageable this year thanks to lower prices and borrowing rates,” said TRREB Chief Information Officer Jason Mercer.

“But despite the improved affordability, buyer hesitation remains. Economic uncertainty—particularly surrounding Canada-U.S. trade—continues to weigh on consumer confidence. Stabilizing that relationship and further interest rate cuts could help reenergize the market.”

🏗️ Looking Ahead: Housing Policy & Market Outlook

TRREB CEO John DiMichele emphasized the need for tangible policy action following the federal government’s recent housing commitments:

“To restore affordability, we must cut excessive housing taxes and fees, adopt innovative construction methods, and streamline approval processes to boost supply. These steps would not only help homebuyers but also stimulate economic growth. With inflation under control, the time is right for further rate cuts—especially for first-time buyers and those facing mortgage renewals.”

👀 Thinking of buying or selling this year?

Connect with a local REALTOR® to get expert advice tailored to your area and property type.

All in all, it’s a market that favors buyers, but things can still move fast if the property hits the right price point. If you’re curious about what all this means for your home or area specifically, feel free to get in touch — we’re always happy to help.

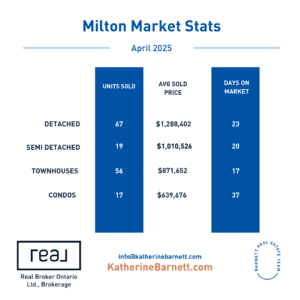

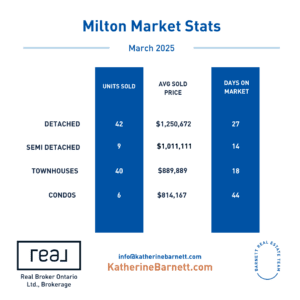

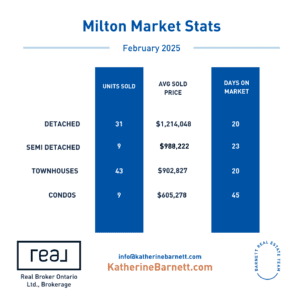

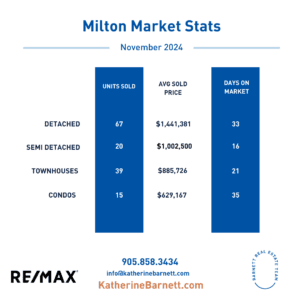

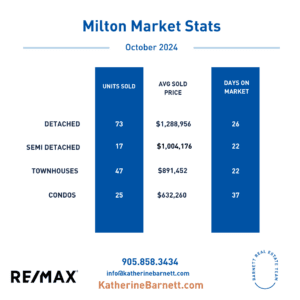

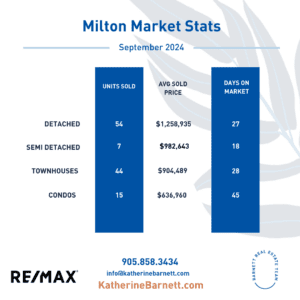

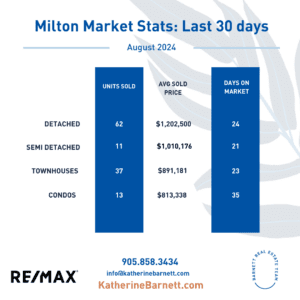

Milton Real Estate Market

The average price in Milton $1,058,365

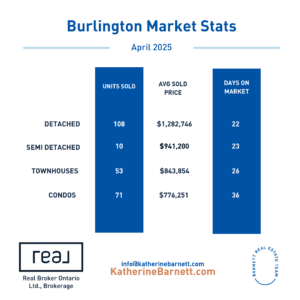

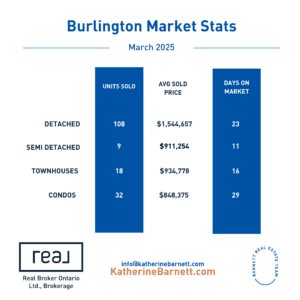

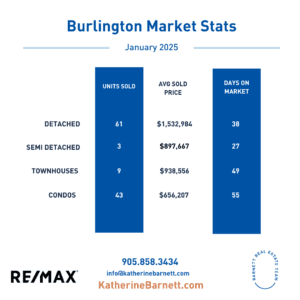

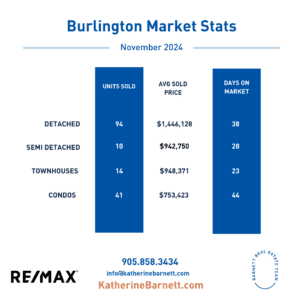

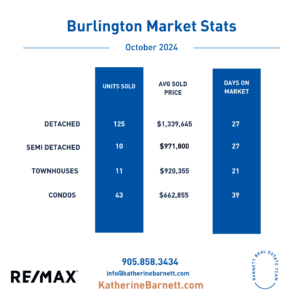

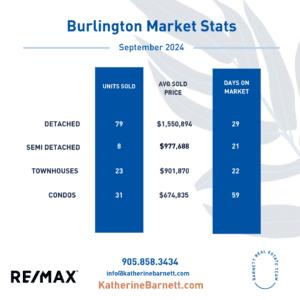

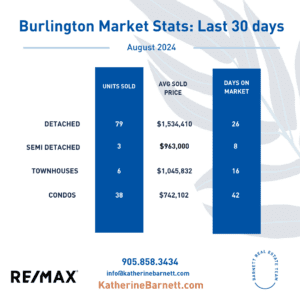

Burlington Real Estate Market

The average price in Burlington $1,120,072

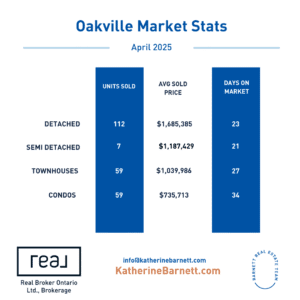

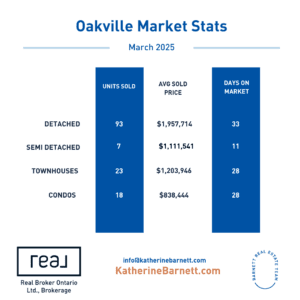

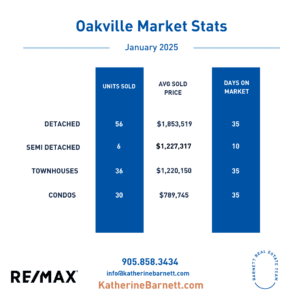

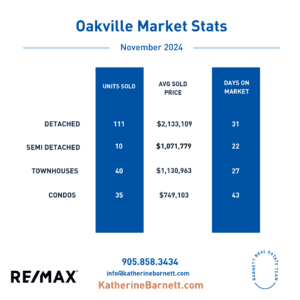

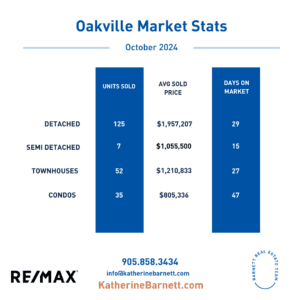

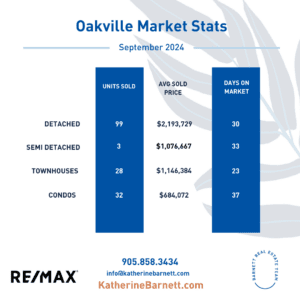

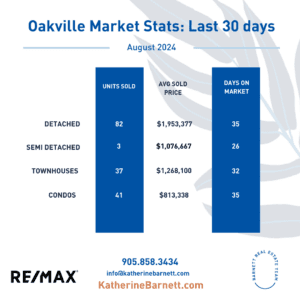

Oakville Real Estate Market

The average price in Oakville $1,058,365

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News