November 2024– GTA Housing Market News

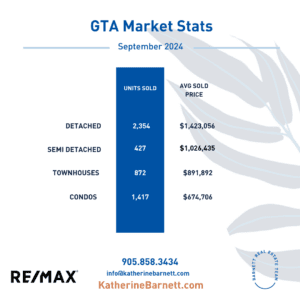

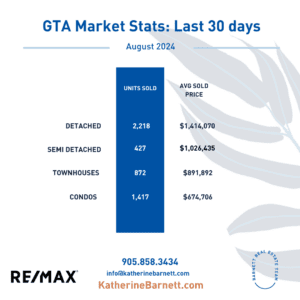

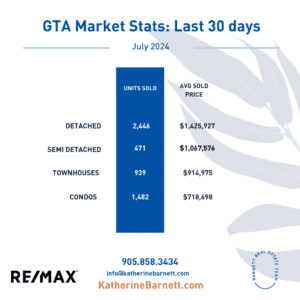

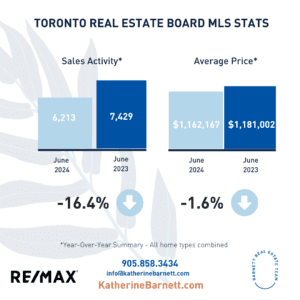

Here is our quick market update for the Toronto Real Estate Board and Milton area.

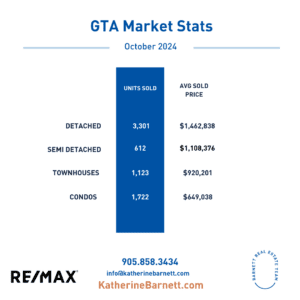

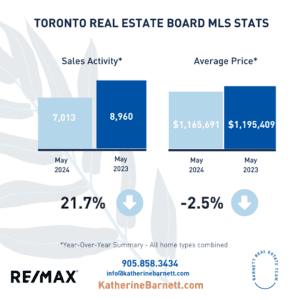

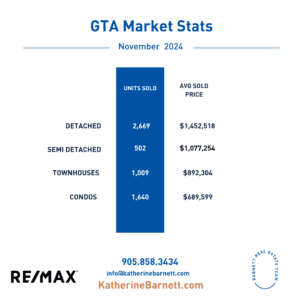

Home sales in the Greater Toronto Area (GTA) surged in November 2024, driven by lower borrowing costs and more affordable market conditions. While new listings also increased compared to last year, they did so at a slower pace, tightening market conditions and leading to price growth.

Heading into 2025, housing conditions have improved, with many buyers returning as inflation eases and borrowing costs decline. With prices still below peak levels and mortgage payments lower, the market is poised for recovery.

In November 2024, there were 5,875 home sales, up 40.1% from November 2023, while new listings rose 6.6% year-over-year. On a seasonally adjusted basis, sales also increased from October.

The MLS® Home Price Index Composite benchmark dropped 1.2% year-over-year, a smaller decline than in recent months. The average selling price, however, rose 2.6% to $1,106,050, driven by more detached home sales. On a seasonally adjusted basis, average prices were slightly lower than October.

Market conditions have tightened, especially for detached homes, with price growth outpacing inflation in Toronto. In contrast, condos saw lower prices, offering buyers more negotiating power. As borrowing costs fall, more renters may enter homeownership.

The rental market will remain balanced as renters transition to buying, though demand may increase with ongoing population growth. Improving efficiency at the Landlord and Tenant Board (LTB) could benefit both tenants and landlords and help more people access affordable homes.

If you are curious about your home or area specifically, please reach out we’re here to help.

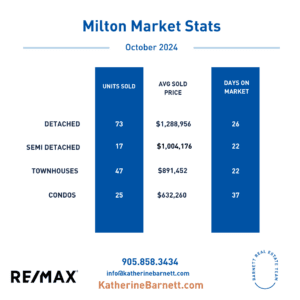

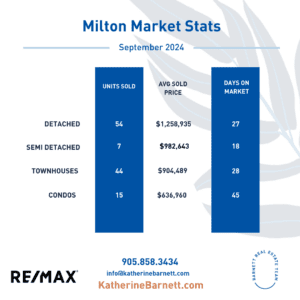

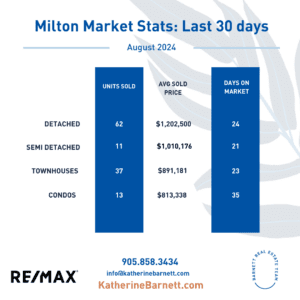

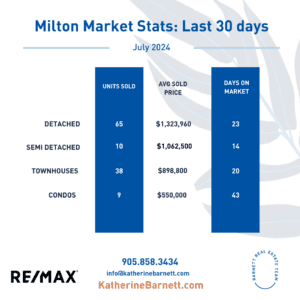

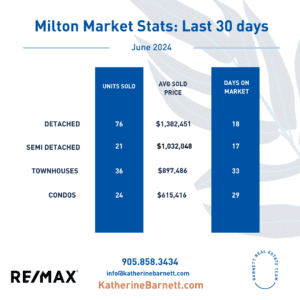

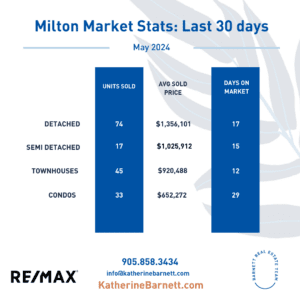

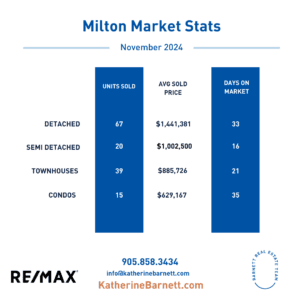

Milton Real Estate Market

The average price in Milton $1,119,939

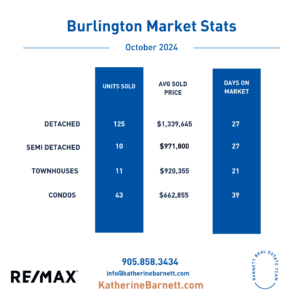

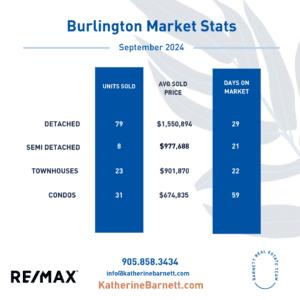

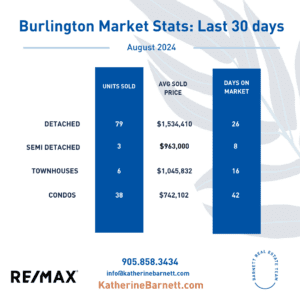

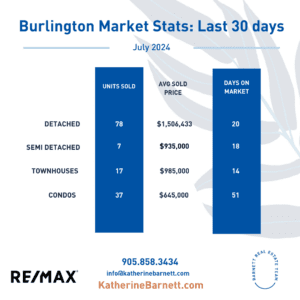

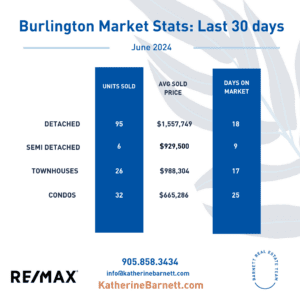

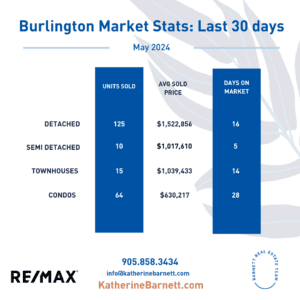

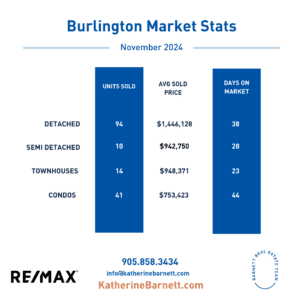

Burlington Real Estate Market

The average price in Burlington $1,128,513

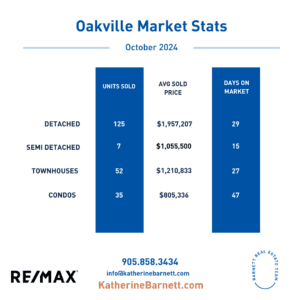

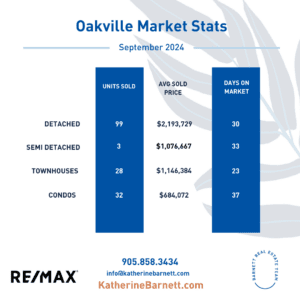

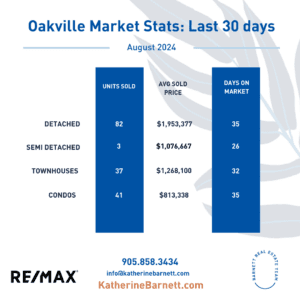

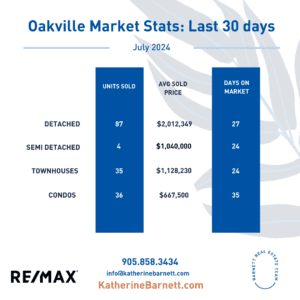

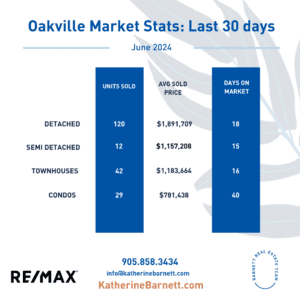

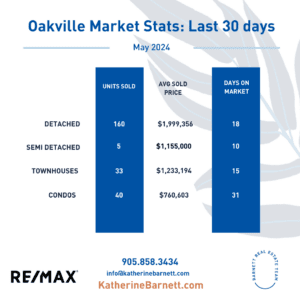

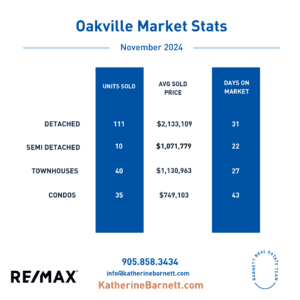

Oakville Real Estate Market

The average price in Oakville $1,558,529

Have questions about the market? Contact us today to learn more!

Previous Reports on GTA Housing Market News