As a real estate team, one of our most important relationships is with the mortgage brokers we work with. Aside from finding your ideal property, the most significant part of the home buying process is securing a mortgage and payment terms.

At the Katherine Barnett Team, we work closely with several mortgage brokers. The reason we work with several is that much like choosing a real estate agent, choosing a mortgage broker is a very personal decision. It’s important to choose an individual who gels with your personality and can help you achieve your goals and meet your budgetary needs.

In this post, we’re talking Agnes Mocko of Mortgage with Agnes and Joanna Skowron of The 6ix Mortgage Group to answer the questions you’ve always wanted to know about working with a mortgage broker.

1. First of All, What’s the True Difference Between a Mortgage Broker and a Bank?

Joanna: When you go straight to the bank, you only have access to what that particular bank offers, and those mortgage programs may not be in alignment with what you need. However, working with a broker is a one-stop-shop! We collect the same information the bank does, but what’s different is that we have access to the whole spectrum of lenders at our fingertips, which includes the bank you were considering going to!

Agnes: Also, a bank has a certain type of box they need their applicants to fit into, which is why a lot of people get turned down. Mortgage Agents provide expert advice and work alongside their clients throughout the entire process. It’s almost as if you have a Google search engine in your back pocket throughout your entire homeownership journey.

Looking for more first-time homebuyer resources? You’ve come to the right place! Check out some of our other blogs:

- The True Cost of Buying a Home: What You Need to Know

- Our Top 8 First-Time Homebuyer FAQs

- How to Hire a Real Estate Agent as a Buyer

2. How Soon Should You Start the Mortgage Application Process when Buying a Home?

Agnes: You should at least have a conversation with a Mortgage Agent as soon as you begin considering buying a home. The reason for this is because sometimes applications need some tweaking in order to get to the desired purchase price. A good mortgage agent can provide you with advice on how to meet your goal once that time comes. When it comes to a pre-approval, it is important to get one done prior to contacting a realtor. The reason for this is because once you have your pre-approval, you can confidently look for homes within your budget, avoiding any disappointment or wasted time on homes that may not be in your reach.

Joanna: I would also add that the speed at which a client gets pre-qualified mainly depends on how quickly the required documents get sent over. I would recommend speaking with a mortgage agent about a week prior to house hunting to give a client adequate time to collect their paperwork and enough time for a mortgage agent to input all the information and ask for clarification if need be!

The great thing about getting a pre-approval is that it offers a ‘rate hold’ that lenders will honour the interest rate the client has been pre-approved for or will adjust the interest rate if it drops for up to 120 days.

3. Fixed-Rate Vs. Variable: Which Type of Mortgage is Better?

Joanna: I wouldn’t necessarily say one is better than the other because it depends on what the client is comfortable with. If you’re the type of person who likes to know exactly how much you’re paying each month for peace of mind, I would recommend a fixed rate. If you’re the type of person who is okay with fluctuation in the payment, paying a little bit more or a little less, depending on how interest rates are looking, a variable rate could be the way to go.

However, generally speaking, variable rates tend to be lower, and historically have shown to be less expensive in the long run.

Agnes: It’s important to understand the penalties within the mortgage contract when making your decision. It’s quite common to see Canadian homeowners break their fixed mortgages. And fixed-rate penalties use either the greater of three months interest or a calculation known as the “Interest Rate Differential” (IRD). This is the difference between the interest rate attached to your mortgage and how it compares to a current rate that most closely matches your remaining term at that point in time. The issue is no one knows where interest rates are heading, making it impossible to predict.

Variable mortgage penalties, on the other hand, typically only consist of up to three months of interest.

Check out more homebuyer resources right here:

4. What’s the Number One Thing First-Time Homebuyers Should Know?

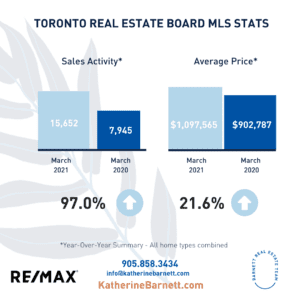

Joanna: Get pre-approved! In a market where homes are flying off the shelves, it is extremely important to know what your budget is. Something I say all the time is house hunting without a pre-approval is like going shopping without knowing how much money you have in your wallet.

And with this pre-approval, the actual submission of your mortgage application is a lot easier. Because the majority of work has been completed in advance, you won’t have to worry about scrambling for paperwork in such a fast-paced environment.

Agnes: I would say to get into the market as soon as you can afford it. You can buy a home with as little as 5% down. Be open-minded when looking for your first home. Remember, you are making an investment.

5. What’s the Difference Between a Mortgage Renewal and Mortgage Re-Finance?

Joanna: When the term of your mortgage is close to expiring, you’ll receive a notice from your lender offering you the option of renewing that mortgage with a new rate, and term. It’s a straightforward process stating that you’d like to move forward with your current lender, under the new specifications.

Agnes: Refinancing a mortgage means you are replacing your existing mortgage with a new mortgage to do things like fund a renovation, take out money to buy an investment, secure a better rate, consolidate debt, etc.

In order to get the money to refinance, an appraisal needs to be conducted on the home and the current mortgage balance is subtracted from this total. A borrower can then access up to 80% of the remaining amount. However, the borrower needs to qualify for this new mortgage amount.

Interested in learning more about mortgage rules and working with a mortgage broker? We host two webinars with Joanna and Agnes each month! Register for the next webinar here and join us live!