Following inflation dropping to 2.7% in April the Bank of Canada dropped interest rates 0.25 basis points last week, bringing the rate down to 4.75% from 5%. This is the first rate cut in over four years, since the pandemic, and signals a shift and a step in the right direction.

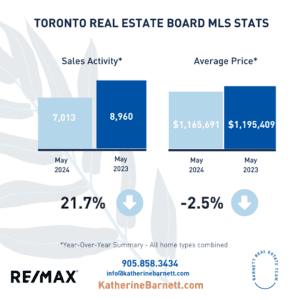

Homeowners with variable mortgages will experience more going towards their principal and homeowners with home lines of credit will have an immediate reduction in their interest rate. Additionally, bond yields have been trending downward resulting in lower fixed rates. This is all great news for Canadian homeowners. May home sales continued at low levels, especially in comparison to last spring’s short lived spring market. The beginning of the year we saw a pickup in the market as interest rates remained flat but as we approached the spring we didn’t experience a typical spring market.

Number of transactions in May was down 21% compared to last year yet interestingly enough new listings were up 21% when compared to last year. Prices are slightly up on an adjusted monthly basis. As affordability is expected to continue to improve as borrowing costs trend lower, demand is expected to increase as more buyers are expected to enter the market including many first-time home buyers.

The next year will be very interesting, reach out if you have any questions.