Homeownership in the Greater Toronto Area (GTA) became more accessible in March 2025 compared to the previous year. Over the past 12 months, both borrowing costs and home prices have declined, making monthly mortgage payments more manageable for prospective buyers.

Affordability has improved over the past year, and with anticipated interest rate cuts this spring, buyers will have more options and greater bargaining power said Toronto Regional Real Estate Board (TRREB) President Elechia Barry-Sproule. Once consumers gain confidence in the economy and job stability, we expect to see an increase in home-buying activity.

TRREB’s Chief Information Officer, Jason Mercer, highlighted the impact of trade uncertainty and the upcoming federal election on buyer sentiment. Many households are adopting a wait-and-see approach. If trade concerns are resolved or public policies help offset tariff effects, home sales are likely to rise. Buyers need to feel secure in their employment before making long-term mortgage commitments he explained.

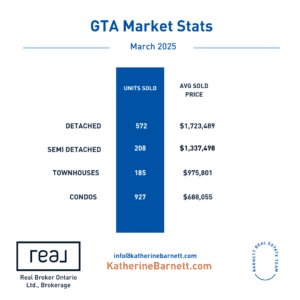

In March 2025, GTA REALTORS® recorded 5,011 home sales through TRREB’s MLS® System, a 23.1% decline from March 2024. However, new listings rose by 28.6% year-over-year to 17,263. On a seasonally adjusted basis, sales in March declined compared to February 2025.

The MLS® Home Price Index Composite benchmark fell by 3.8% year-over-year in March 2025, while the average selling price decreased by 2% to $1,093,254 compared to March 2024. Month-over-month, the MLS® HPI Composite showed a downward trend, while the average selling price remained stable.

As we approach the federal election, much of the policy discussion has revolved around Canada’s trade relationships. However, it is encouraging to see housing affordability remain a key priority across party platforms Mercer noted. Recent polling shows that access to affordable housing is a top concern for Canadians, and increasing housing supply will play a crucial role in driving economic growth.

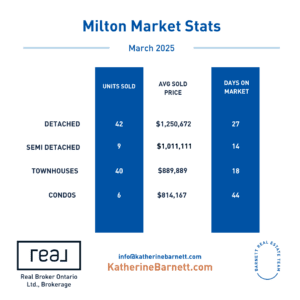

Milton Market Update – March 2025

The Milton real estate market continued to show mixed dynamics across housing types in March, with shifting inventory levels and steady demand.

-

Detached Homes:

The average price for detached homes sits at $1.2 million, with the market showing signs of balance, supported by 5.5 months of inventory (MOI). Buyers and sellers are on relatively equal footing in this segment.

-

Townhomes:

Townhomes remain in high demand, with an average price of $902,000. This segment is currently in a seller’s market, supported by just over 2 months of inventory. Prices are up 1.4% month-over-month, reflecting strong buyer interest and limited supply.

- Condo Apartments:

Condo prices are holding steady, averaging around $600,000. Like the detached home segment, condos are experiencing a balanced market with 5.5 months of inventory, indicating stable conditions for both buyers and sellers.

If you are curious about your home or area specifically, please reach out we’re here to help.