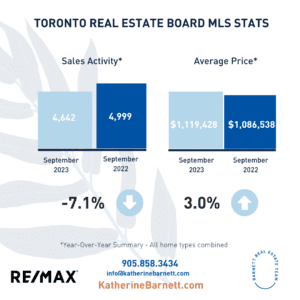

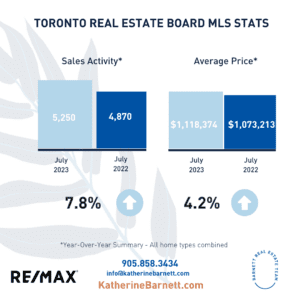

The Canadian real estate market has seen significant price increases in recent years, this growth has boosted home equity for many homeowners. With rising home values comes a noticeable uptick in home equity loans. Many homeowners are tapping into their home equity to finance everything from renovations to consolidating high-interest debts.

Home equity is essentially the financial stake you have in your house. It’s the monetary difference between your home’s current market value and the remaining balance on your mortgage. When property values in your area rise, the value of your home increases, and so does your home equity!

With longer life expectancies and concerns about the adequacy of retirement savings, some Canadians view their home equity as a sort of retirement nest egg. Older homeowners opt to downsize by selling their family homes to move into smaller properties or condominiums. This allows them to release the equity built up in their homes for retirement or other needs.

Home equity can be a powerful financial tool. Here are a few ways you can take advantage of it.

Access Fresh Funds by Refinancing Your Home

When market conditions improve and lower interest rates become available, you can renegotiate the terms of your existing mortgage and replace it with a new one. If you’ve owned your home for several years and have dutifully made mortgage payments, you’ve likely built-up considerable equity. Refinancing allows you to tap into this to finance major expenses.

Refinancing can also allow you to take advantage of lower interest rates, thus reducing your monthly mortgage payments. This can translate into significant savings over the life of your loan. Keep in mind that extending your repayment period might lead to higher overall interest costs.

Before you decide to refinance, it’s crucial to weigh the costs against the benefits. Just like your original mortgage, refinancing comes with closing costs. These can include application fees, legal fees, appraisal fees, and more.

Note that because you are effectively breaking the initial mortgage contract by refinancing, most lenders impose a penalty to compensate for the financial loss they incur. Generally, the closer you are to the end of your mortgage term, the less severe the penalty will be. This is because the lender stands to lose less interest over a shorter period. In some cases, you can negotiate the prepayment penalty with your lender, especially if you plan to stick with the same lender for your refinanced mortgage.

Take Advantage of a Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) operates like a credit card but uses your home as collateral. It’s a type of loan that provides you with a revolving line of credit based on the equity you’ve built up in your home. You can borrow any amount at any time. This can be especially useful for ongoing expenses like home renovations or investments.

Be mindful of the fact that, unlike traditional home loans, HELOCs usually come with variable interest rates, meaning the rates can rise or fall over time. If interest rates increase, so do your monthly payments, which can lead to higher repayment costs. Keep a close eye on interest rate trends. If rates start climbing, consider paying down your HELOC faster to minimize the impact of future rate hikes.

Leverage Your Home Equity for Other Investments

Funds from a home equity loan, HELOC, or cash-out refinance gives you the opportunity to invest in other properties, the stock market, start a business, or fund other income-generating ventures. If the investment does well, it could yield a return rate surpassing your equity loan’s interest rate. This difference, less any loan costs, is your net profit. The interest on the money borrowed against your home equity to buy an income-generating property or invest in a business may be tax-deductible. But you must meet specific requirements set by the Canada Revenue Agency.

If you cannot repay the loan, you could face the harsh reality of losing your home. It’s a sobering thought that underscores the need to make informed, prudent financial decisions.

Increase Your Home’s Value Through Home Improvements

Undertaking home improvements can increase the value of your property. Renovations such as upgrading the kitchen, adding a bathroom, or finishing a basement are known to yield a high return on investment. When you decide to sell your home, you can recoup your investment or even make a profit. Improvements can make your home more comfortable, practical, and enjoyable. For example, expanding your living space could accommodate a growing family, while upgrading insulation can enhance energy efficiency and reduce utility costs. In Canada, certain types of home improvements can provide tax benefits, such as the Home Accessibility Tax Credit (HATC). This allows deductions for eligible home renovation expenses for seniors and persons with disabilities.

Not all home improvements add significant value to a home, and it’s possible to spend more on renovations than you can recoup in a sale. This is known as overcapitalization. Doing your research and consulting with one of our team member before embarking on any significant projects is essential.

Are you considering selling your home? The Barnett Real Estate Team understands what makes a property sell at the highest price possible. From strategic home staging to effective marketing, we ensure your home stands out in the market, attracting competitive offers.

Contact us for a consultation.