Whether you are increasing your family size or desiring to flee the city, there are many reasons why households typically uproot their households. But this also leads to another interesting question: What should you do with your current home?

For some, the answer is simple: sell it and move on. For others, households might want to use it as a rental property. In any case, it is essential to mull over current economic and market conditions.

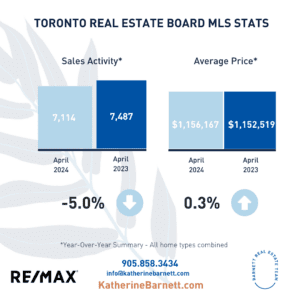

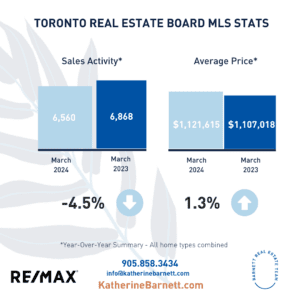

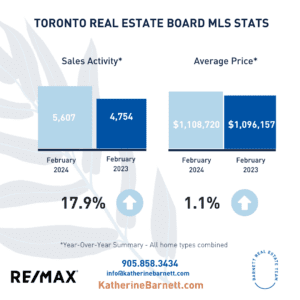

A chorus of financial experts anticipates mortgage rates easing as the year progresses. With the annual rate of inflation easing toward the Bank of Canada’s (BoC) two percent target, investors expect the institution to cut interest rates soon. While the monetary authorities are engaged in a balancing act, many economists purport that policymakers do not want to keep interest rates higher than they need to so they can avert an economic downturn.

This is good news for buyers and sellers, especially for households that fall into the move-up buyer category. Although the average fixed-rate five-year mortgage hovers around six percent, many expect it to slow to five percent by the year’s end, which could encourage homeowners to make that leap and place their residential properties on the open market. This would, in theory, add more supply to housing inventories and possibly limit price growth.

But while first-time homeowners consider cashing in on their equity, taking advantage of lower interest rates, and moving into a bigger house, they might also consider using their first home as a rental property.

Let’s take a look at the pros and cons of keeping your first home as a rental property.

The Pros of Keeping Your First Home as a Rental Property

Here are the three advantages of keeping your first home as a rental property:

First Step Toward Real Estate Investing

Let’s be honest: Housing is a hot commodity these days. Despite the country’s vast size, there are not enough homes to accommodate Canada’s growing population, creating an enormous supply-and-demand imbalance from coast to coast. As a result, there is a tremendous opportunity for real estate investing. Since you have the luxury of already owning a home, this could be your opportunity to rent the house or condo while you buy your second home. This is an impeccable strategy for building wealth.

Passive Income

Yes, renting out your first home involves some work, and it will require time and effort, be it home repairs or property tax payments. However, for the most part, this is a passive income-generation tactic to bolster your monthly surplus. As alluded to in the first point, this is one of the best ways to build wealth.

Taxes

Are you looking to reduce your tax bill? Well, using your residential property as a rental unit can help you decrease the taxes you owe. Believe it or not, there is a treasure trove of certain expenses that you can deduct:

- Mortgage interest

- Insurance

- Utility bills

- Maintenance and upgrades

- Property management

In addition, should your expenses surpass your rental income, you could deduct these losses from any other income sources, meaning you can trim your tax bill.

At a time when governments everywhere are exploring tools to boost rental supply, this could be an opportune time to join the landlord business.

The Cons of Keeping Your First Home as a Rental Property

Here are three disadvantages of keeping your first home as a rental property:

Property Management Challenges

You might have heard the horror stories of being a landlord. Tenants are not paying the rent, are constantly late, and are destroying the unit. Unfortunately, this requires additional investments, from immense legal fees to costly repairs, that could affect your cash flow.

Missing Out on Cash Injection

The average home in Canada sells for close to $700,000, according to the Canada Real Estate Association (CREA). Of course, the selling price is much higher in places like Toronto. The point is that you could miss out on immediate profits should you rent out your first home rather than erect a for-sale sign. As the world has experienced in the last few years, many things can change overnight. So, potentially waiting to cash out could risk leaving money on the table.

What About the Future?

Should you decide that being a landlord and maintaining your new home are incompatible with your lifestyle, listing your first property on the open market could be challenging. This could be due to various reasons, such as renters damaging the property or the economic climate changing.

Moving Up in Today’s Housing Market

Whatever you decide to do with your first home, moving up is a significant milestone for you and your family. Therefore, you want to do what suits the household and your wallet. Is utilizing your first home as a rental property the correct decision? It is a matter of doing your research, consulting with Barnett Real Estate agent, speaking with a financial advisor, and understanding the market.